Past research relating U.S. stock market returns to the party holding the Presidency mostly concludes that Democratic presidents are better for the stock market than Republican presidents. However, Presidents share power conferred by the electorate with Congress. Does historical data confirm that Democratic control of Congress is also better for stock market returns than Republican control of Congress? Is control of the smaller Senate more decisive than control of the House of Representatives? To check, we relate annual U.S. stock market (S&P 500 Index) returns to various combinations of party control of the Presidency, the Senate and the House of Representatives. Using party in power data and annual levels of the S&P 500 Index for December 1927 through December 2023 (96 years), we find that:

There are two years (1931-1932) for which the House of Representatives has equal numbers of Republicans and Democrats. We exclude House-related power combinations for those two years. We do assign the 2021 and 2022 Senates to the Democrats based on the Vice President’s tie-breaker vote.

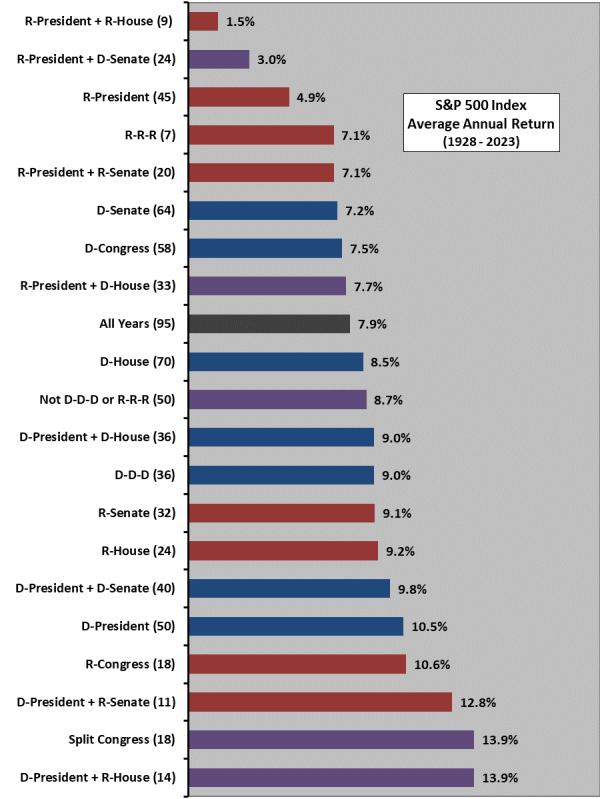

The following chart summarizes average calendar year S&P 500 Index returns for various combinations of party in power over the full sample period. The number in parentheses after each combination is the number of years during which the combination holds. Some subsamples are extremely small. Results suggest that stocks do better when Democrats (Republicans) control the Presidency (House, Senate or both).

Using “election year” (November through October) returns rather than calendar year returns makes little difference.

In summary, evidence suggests that divided government, with a Democrat as President and Republican control of part or all of Congress is the most favorable for U.S. stocks.

Cautions regarding findings include:

- As noted, subsamples are very small for reliable inference.

- The margins of power in the Senate and House of Representatives may be factors, but the small sample/subsample sizes argue against further stratification.

See also results of this search, and specifically: