Do book value-to-price ratio (B/P) and earnings-to-price ratio (E/P) indicate reward-for-risk opportunities at the country level worldwide? In their September 2013 paper entitled “Risky Value”, Atif Ellahie, Michael Katz and Scott Richardson investigate relationships among these valuation ratios, earnings growth and future returns at the country level for 30 countries over the past two decades. They construct monthly country-level valuation and earnings growth outlooks from capitalization-weighted firm fundamentals and earnings forecasts. They then relate these measures to country capitalization-weighted stock market future excess returns (relative to local risk-free rates), with the return measurement interval commencing four month after fundamentals are available. They replace negative country-level E/P values with zero. Using monthly firm-level fundamentals and stock data, as well as macroeconomic forecasts, for 30 countries during March 1993 through June 2011 (6,600 country-month observations), they find that:

- Countries with relatively high B/P tend to have greater dispersion in future earnings growth and greater sensitivity of future earnings growth to global earnings growth during global downturns. In other words, high B/P indicates overall and downside risks in earnings growth at the country level.

- Countries with relatively high B/P tend to have higher future earnings growth, and country-level E/P and B/P jointly explain differences in country future gross excess stock market returns. In other words, bearing the risk indicated by high B/P relates to reward at the country level.

- After controlling for E/P and B/P, dividend-to-price ratio (D/P) is unrelated to future gross excess stock market return at the country level. In other words, dividends do not measure value creation.

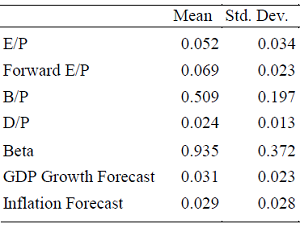

The following chart, extracted from the paper, summarizes basic country-level statistics for seven financial and economic variables across 30 countries during March 1993 through June 2011. E/P (Forward E/P) is based on realized (forecasted) earnings. Beta derives from 36-month rolling regressions of monthly capitalization-weighted country stock market returns versus monthly returns from a global stock market index. Gross Domestic Product (GDP) growth and inflation forecasts by country are averages of expert inputs.

In summary, evidence suggests that investors can earn a reward by investing in stock markets of countries with risky earnings growth expectations, as indicated by high country-level book value-to-price ratios.

Cautions regarding findings included:

- Country-level return estimates are index-like. Incorporating the costs of creating and maintaining tracking funds for these indexes would reduce reported returns. Costs may vary by country, such that findings based on net returns may differ from those based on gross returns.

- Incorporating costs for the considerable data collection and processing efforts described in the study would reduce reported returns (or, if delegated, materialize as research/management fees).

- The study does not test any trading strategies to exploit the return implications of country-level B/P and E/P.