Why has value investing (long undervalued stocks and short overvalued stocks) performed poorly since 2007? Is it dead, or will it recover? In their August 2019 paper entitled “Explaining the Demise of Value Investing”, Baruch Lev and Anup Srivastava examine the performance of the Fama-French value (HML) factor portfolio, long stocks with high book value-to-market capitalization ratios and short those with low ratios, because it is the most widely used value strategy. They then investigate reasons for its faltering performance. Using value factor returns and accounting data for a broad sample of U.S. stocks during January 1970 through December 2018, they conclude that:

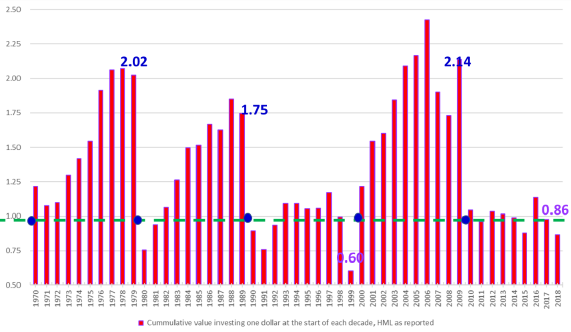

- Value investing is unprofitable over the last 30 years, except for a few years in the early 2000s (see the chart below).

- One reason for the demise of value investing is systematic misidentification of value and growth stocks based on book value.

- Book value ignores value-creating intangibles such as research and development, information technology, brand development and human resources, all immediately expensed rather than booked as capital assets.

- Investment in intangibles becomes increasingly important starting in the late 1980s, surpassing $2 trillion in 2017. By 2018, median firm intangible investments represent a book-to-market ratio close to 3.0.

- Adjusting book-to-market ratios with intangibles capitalized rather than expensed substantially alters designation of firms as value or growth, such that:

- An adjusted HML factor generates higher average gross returns than the conventional factor for 34 of 39 years during 1970-2018.

- An adjusted long-only (H) value strategy has modest gain in the 1990s, very large gain during 2000-2009, but essentially no gain thereafter.

- Another reason for the demise of value investing is a slowdown in reshuffling (mean reversion) of value and growth stocks during 2007-2018, as evidenced by:

- A substantial increase in correlation of a stock’s book-to-market ratio rank at the end of one year to its rank at the end of the prior year.

- An increase in average length of stay for value (growth) stocks from 2.5 (3.5) years during 1989-2006 to 3.3 (4.5) years during 2007-2018.

- A decrease in annual frequency of >10% upticks (downticks) for value (growth) stocks from 22% (18%) during 2000-2006 to just 10% (10%) during 2007-2018.

- During 2007-2018, value (growth) firms have the lowest (highest) average profitability since 1970. Poor profitability and tight post-recession bank lending prevent most value firms from investing in innovation and growth. The opposite holds for growth firms. The only indicator that consistently distinguishes value firm escapees from trapped value firms is large research and development investment.

- While an unusually large difference between median book-to-market ratios of value and growth firms firms may be bullish for value, this difference is not now markedly higher than those in the late 1990s and early 2000s.

The following chart, taken from the paper, summarizes HML factor portfolio cumulative gross performance by decade during 1970-2018. The 10-year return on an investment made at the beginning of:

- 1970 is 102% return (7.2% compounded).

- 1980 is 75% return (5.7% compounded).

- 1990 is -40% (-5.0% compounded).

- 2000 is 114% (7.9% compounded).

- 2010 (through 2018) is -14% (-1.9 compounded).

Shorting growth stocks that crashed (which may have been costly/difficult at times) drives the exceptional performance during the 2000s.

In summary, evidence offers no clear path for resurrection of value investing.

Cautions regarding conclusions include:

- Analyses are gross, not net. Accounting for costs of value factor portfolio annual reformation and shorting costs/constraints would weaken reported HML factor performance.

- As noted the strong gross performance of value during the 2000s may have been difficult to exploit due to dependence on shorting stock crashes.

- Value investing as specified may not be representative of more precisely targeted value strategies.