Do hedge fund managers who use technical analysis beat those who do not? In their May 2014 paper entitled “Sentiment and the Effectiveness of Technical Analysis: Evidence from the Hedge Fund Industry”, David Smith, Na Wang, Ying Wang and Edward Zychowicz examine the relative performance of users and non-users of technical analysis among hedge fund managers in different sentiment environments. They hypothesize that short-selling constraints prevent market correction of mispricings when sentiment is high (overly optimistic), but not when sentiment is low (overly pessimistic). Discovery of mispricings via technical analysis may therefore be more effective when sentiment is high. To test their hypothesis, they compare the performance of hedge funds that report using technical analysis to that of hedge funds that do not, with focus on the state of market sentiment. They define the market sentiment state as high or low depending on whether the monthly Baker-Wurgler market sentiment measure is above or below its full-sample median. Using end-of-period status on use/non-use of technical analysis and monthly returns for 3,290 live and 1,845 dead funds from the Lipper TASS hedge fund database and monthly market sentiment data during January 1994 through December 2010, they find that:

- 19.1% of hedge funds (981 of 5,135) report using technical analysis.

- Among live (dead) funds, 21.6% (14.6%) report using technical analysis.

- Fund age relates positively to reported use of technical analysis.

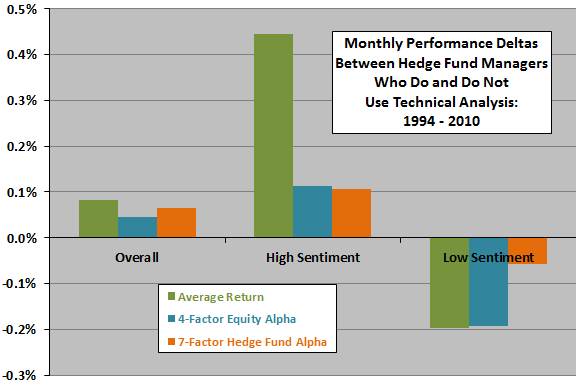

- Regarding relative performance of technical analysis users and non-users (see the chart below):

- Over the entire sample period, the average monthly return of users (non-users) of technical analysis is 0.53% (0.45%). Based on monthly four-factor (market, size, book-to-market, momentum) equity alpha, technical analysis users outperform non-users by a statistically insignificant 0.04%. Based on monthly seven-factor hedge fund alpha, technical analysis users outperform non-users by a statistically significant 0.07%.

- When market sentiment is high, technical analysis users exhibit significantly higher returns, lower risk and better market timing than non-users.

- When market sentiment is low and the market relatively efficient, the advantages of technical analysis disappear.

- Correspondingly, hedge funds reporting use of fundamental analysis tend to underperform when market sentiment is high.

- Findings generally hold across subperiods, and after controlling for sentiment level and fund characteristics such as equity focus, lockup period, fees and use of leverage and derivatives.

The following chart, constructed from data in the paper, summarizes the relative monthly performance of hedge funds grouped by reported use/non-use of technical analysis overall and during times of relatively high and low market sentiment. Results indicate that technical analysis tends to boost (retard) fund performance when market sentiment is high (low).

In summary, evidence suggests that technical analysis works when investor optimism creates mispricings that persist due to short-selling constraints, but not when investors are pessimistic.

Cautions regarding findings include:

- The method of specifying high and low levels of market sentiment (based on the median for the full sample period) impounds look-ahead bias. An investor operating in real time (using only prior sentiment data) may calculate different thresholds for high and low sentiment at different times.

- Results are in-sample. Investors would need to predict market sentiment to exploit the technical analysis-sentiment relationship.

For related research, see “Technical Analysis as a Mutual Fund Discriminator”.