Value Investing Strategy (Strategy Overview)

Momentum Investing Strategy (Strategy Overview)

Best Factor Model of U.S. Stock Returns?

December 6, 2019 • Posted in Animal Spirits, Equity Premium, Fundamental Valuation, Momentum Investing

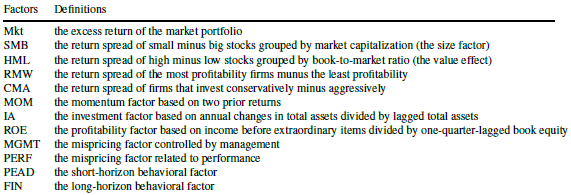

Which equity factors from among those included in the most widely accepted factor models are really important? In their October 2019 paper entitled “Winners from Winners: A Tale of Risk Factors”, Siddhartha Chib, Lingxiao Zhao, Dashan Huang and Guofu Zhou examine what set of equity factors from among the 12 used in four models with wide acceptance best explain behaviors of U.S. stocks. Their starting point is therefore the following market, fundamental and behavioral factors:

They compare 4,095 subsets (models) of these 12 factors models based on: Bayesian posterior probability; out-of-sample return forecasting performance; gross Sharpe ratios of the optimal mean variance factor portfolio; and, ability to explain various stock return anomalies. Using monthly data for the selected factors during January 1974 through December 2018, with the first 10 (last 12) months reserved for Bayesian prior training (out-of-sample testing), they find that: (more…)

Please log in or subscribe to continue reading...

Gain access to hundreds of premium articles, our momentum strategy, full RSS feeds, and more! Learn more