Does the S&P 500 options-implied volatility index (VIX) exhibit predictable daily, overnight and intraday tendencies? In their September 2012 paper entitled “What Makes the VIX Tick?”, Warren Bailey, Lin Zheng and Yinggang Zhou employ high-frequency data to investigate patterns in VIX behavior and measure relationships between VIX and various financial fundamentals, economic announcements and investor sentiment. Using data for VIX and other variables sampled at one-minute intervals (as appropriate) during January 2005 through June 2010, they find that:

- The average level of VIX is 0.40 to 0.72 higher on Mondays than on other days of the week.

- The average close-to-open change in VIX is positive and about five times higher over weekends than over weeknights (0.68 versus 0.12). In contrast, the average overnight change in VIX before the third Friday of each month, when the S&P 500 Index options used to compute VIX roll, is negative and more than double the magnitude of the average weeknight change (-0.27).

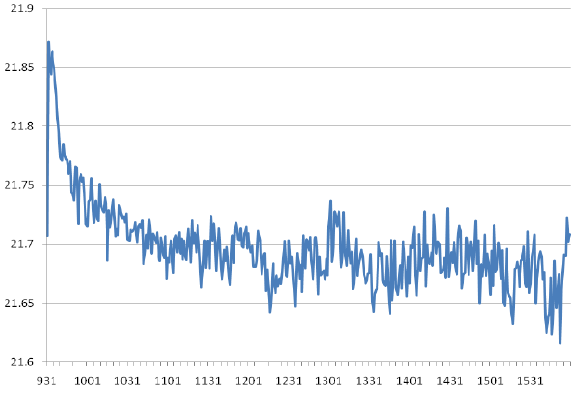

- VIX tends to be highest near the start of the trading day, with a pronounced spike just after the open (see the chart below).

- High-frequency VIX responses to changes in other variables tend to die out after about five minutes. The response with the largest magnitude is reversion of changes in VIX itself. In other words, an upward (downward) spike in VIX tends to be followed by a downward (upward) move the next minute.

The following chart, taken from the paper, shows the average minute-by-minute value of VIX over the entire sample period. While VIX tends to be highest just after the start of the trading day, this peak is not large in magnitude. Other aspects of the S&P 500 Index, such as the bid-ask spread for SPY, echo this behavior.

In summary, evidence indicates that VIX exhibits some fairly reliable daily, intraday and high-frequency behaviors.

Cautions regarding findings include:

- The magnitudes of predictable VIX tendencies are generally small.

- VIX is not directly tradable. VIX futures and derivative assets may anticipate VIX tendencies and therefore behave differently. See, for example, “VIX Calendar Effects”.