Can investors exploit the volatility risk premium to improve the hedging performance of S&P 500 Implied Volatility Index (VIX) futures? In his November 2019 paper entitled “Portfolio Strategies for Volatility Investing”, Jim Campasano tests an Enhanced Portfolio strategy which dynamically allocates to the S&P 500 Index and a position in the two nearest VIX futures re-weighted daily to maintain constant 30 days to maturity (VIX30). He specifies the volatility risk premium as VIX30 minus VIX. The Enhanced Portfolio holds a long (short) position in VIX30 when this premium is negative (positive). Within this portfolio, he each day weights the S&P 500 Index and VIX30 so that they have the same expected volatility per predictive regressions starting January 2007. He imposes a 1-day lag between calculations of VIX30 direction/portfolio weights and trading to ensure availability of all inputs. As benchmarks, because of their interactions with the volatility risk premium, he considers three variations of the CBOE S&P 500 BuyWrite Index (BXM, BXY and BXMD), the CBOE S&P 500 PutWrite Index (PUT), a call writing strategy that sells calls only when VIX is above its historical median (COND) and a delta-hedged covered call strategy (RM). He further considers three variants of his Enhanced Portfolio: (1) EnhancedLong holds the S&P 500 Index (Enhanced Portfolio) when the VIX premium is positive (negative); (2) EnhancedShort holds the S&P 500 Index (Enhanced Portfolio ) when the VIX premium is negative (positive); and, (3) Enhanced90 adjusts allocations so that the S&P 500 Index has 90% of expected portfolio volatility. Using the specified daily data during January 2007 through December 2017, he finds that:

- Over the full sample period, average long (short) allocation to VIX30 is about 26% (20%). The long allocation is highest (49%) during the 2008-2009 financial crisis, and it also spikes during the European debt crisis in 2010 and the U.S. debt ceiling crisis in 2011. The allocation is long 27% of the time.

- Over the full sample period, the Enhanced Portfolio has:

- Average gross monthly return 2.1%, far higher than 0.8% for the S&P 500 Index and returns for all benchmarks.

- Average monthly volatility 5.9%, also much higher than 4.3% for the S&P 500 Index and volatilities for all benchmarks.

- Annualized gross Sharpe (Sortino) ratio 1.19 (2.44), easily beating the 0.58 (0.83) for the S&P 500 Index and ratios for all benchmarks.

- A drawdown of just -5.7% when the S&P 500 Index has its maximum drawdown (-55%), and mostly shallower drawdowns than the index and all benchmarks during market dips.

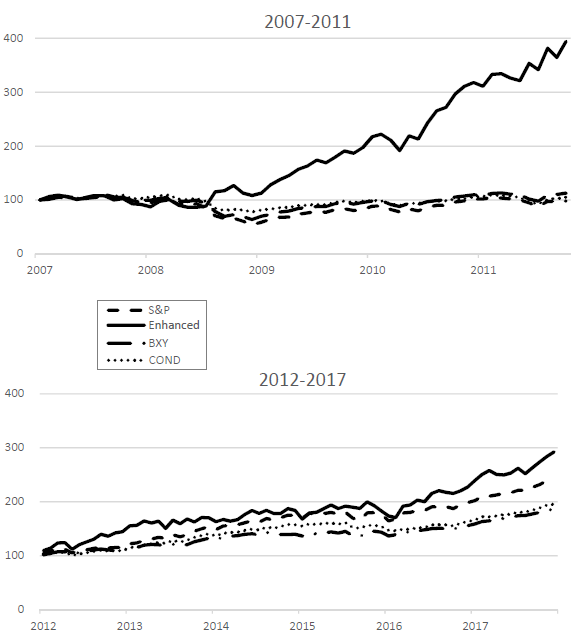

- During the April 2007 through 2011 subperiod, outperformance of the Enhanced Portfolio compared to the S&P 500 Index and benchmarks is even more pronounced, with gross Sharpe (Sortino) ratio 1.23 (2.69). During 2008 (2011) the Enhanced Portfolio generates gross return 24% (33%), compared to -37% (2.1%) for the S&P 500 Index. (See the first chart below.)

- During the 2012 through 2017 subperiod, however, the Enhanced Portfolio underperforms the S&P 500 Index and all benchmarks, while still generating a good gross Sharpe (Sortino) ratio of 1.01 (2.02). (See the second chart below.)

- Viewed in isolation:

- Over the full sample period, long (short) VIX30 positions have 0.12% (0.05%) average gross daily return with annualized gross Sharpe ratio 1.18 (1.18).

- Annualized gross Sharpe ratios across the two subperiods are very different for long VIX30 positions (2.11 and -1.56), but are consistent for short positions (1.37 and 1.03).

- Monte Carlo simulation of 10,000 subsamples with duration at least 12 months indicates that the Enhanced Portfolio beats the S&P 500 Index 56% (70%) of the time based on gross Sharpe (Sortino) ratio.

- On a gross basis over the full sample period, the three Enhanced Portfolio variants beat the S&P 500 Index but lose to the Enhanced Portfolio itself. During the April 2007 through 2011 (2012 through 2017) subperiod, the variants substantially underperform (outperform) the Enhanced Portfolio.

The following charts, taken from the paper, track gross cumulative values of $100 initial investments in the S&P 500 Index (S&P), the Enhanced Portfolio (Enhanced) and both BXY and COND benchmarks during April 2007 through 2011 (upper chart) and 2012 through 2017 (lower chart) subperiods. During the first subperiod, the Enhanced Portfolio outperforms due to strong performance during 2008 and 2011 market crashes. During the second subperiod, with no market crashes, the Enhanced Portfolio is competitive with the S&P 500 Index and benchmarks but is relatively volatile.

In summary, evidence suggests that by changing the direction of an allocation to volatility according to the sign of the volatility risk premium, investors can protect equity positions from crashes with little sacrifice during calm times.

Cautions regarding findings include:

- Reported findings are gross, not net. Daily rebalancing of (1) VIX30 to maintain constant maturity and (2) Enhanced Portfolio weights for the S&P 500 Index and VIX30 to maintain risk parity may generate material cumulative trading frictions. These frictions would reduce returns and may affect findings.

- Testing multiple strategy variations and benchmarks on the same sample introduces data snooping bias, such that the best-performing strategy overstates expectations. There may be additional bias from unreported experimental selection of model features and parameter values.

- Daily portfolio tracking/adjustment is beyond the attention of many investors, who would bear fees for delegating the process to a fund manager.

For other perspectives on exploiting the volatility risk premium, see results of this search.