What are the principal strategies for exploiting the volatility and volatility skew risk premiums? In his May 2016 workshop presentation package entitled “Volatility Modelling and Trading”, Artur Sepp provides an overview of systematic volatility risk premium capture strategies. He focuses on simple rule-based strategies with monthly reformation suitable for an investable index or a proprietary strategy. He covers delta-hedged strategies for capturing the volatility/volatility skew risk premiums (straddles/strangles) and buy-write and put-write options strategies as applied to major stock indexes and liquid exchange-traded funds (ETF). He covers the following strategy elements:

- Measuring realized volatility.

- Forecasting expected volatility.

- Measuring and forecasting implied and realized volatility skew.

- Computing option delta.

- Trading off transaction costs versus delta risk.

- Managing tail risk.

Using relevant data for target assets during January 2005 through January 2016, he finds that:

- Over the selected sample period, a straddle strategy that each month sells one-month at-the-money puts and calls on SPDR S&P 500 (SPY) options and holds to expiration with daily delta hedge adjustments (subject to 0.03% trading frictions) generates annualized return 7.43%, annualized volatility 8.0%, annualized Sharpe ratio 0.88 and maximum drawdown -19%. Comparable performance data for the S&P 500 Index are annualized return 6.58%, annualized volatility 18.0%, annualized Sharpe ratio 0.36 and maximum drawdown -52%.

- Over the selected sample period, a strangle strategy that each month sells one-month out-of-the-money puts and calls on SPY options and holds to expiration with daily delta hedge adjustments (subject to 0.03% trading frictions) generates annualized return 8.55%, annualized volatility 7.0%, annualized Sharpe ratio 1.21 and maximum drawdown -19%.

- There is a trade-off between hedging precision (rebalancing frequency) and trading frictions required to adjust hedges.

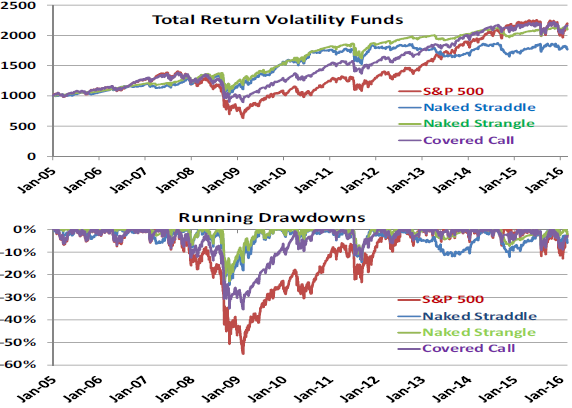

- In general, simple volatility premium harvesting strategies capture much or all of equity market performance with lower volatilities and less severe maximum drawdowns (see the charts below).

The following charts, taken from the presentation, compare cumulative total performances (upper chart) and cumulative drawdowns (lower chart) for four simple strategies over the sample period:

- Buy and hold SPY (S&P 500).

- Rolling SPY straddles as specified above covered by cash (Naked Straddle).

- Rolling SPY strangles as specified above covered by cash (Naked Strangle).

- Rolling covered calls (Covered Call).

Results show that the option strategies capture much or all of equity market performance with lower volatilities and less severe maximum drawdowns.

In summary, evidence from a recent 11-year sample indicates that systematic short option strategies designed to capture the volatility and volatility skew risk premiums capture much or all of the underlying equity premium with relatively low volatilities and shallow maximum drawdowns.

Cautions regarding findings include:

- The sample period is short for analysis of annualized performance. Moreover, the sample includes the very unusual market crash and rebound of 2008-2009, but the presentation does not test robustness to exclusion of this event.

- The transaction costs assumed for establishing and maintaining delta hedges (0.03% of trade value) may be unachievable by some investors.

- At times, the presentation format is vague. It appears that performance calculations do not include trading frictions for opening and, when necessary, closing short option positions. Calculations do not include any fees for investors delegating strategy execution to an investment manager/fund.

- ETFs that implement the CBOE S&P 500 call-write and put-write indexes fall short of the hypothetical performances of those indexes (see “Simple Stock Index Option Strategies”).

See also:

- “Performance of CBOE PutWrite Indexes”

- “Enhancement of Index Covered Calls via Hedging”

- “Stress Test for Equity Index Option Strategies”

- “Option Straddles Around Earnings Announcements”

- The live “Strategy Test” of selling equity index put options.