Generally, when stocks go up (down), iPath S&P 500 VIX Short Term Futures (VXX) goes down (up). A reader asked what happens after stocks and VXX move in the same direction. Is this unusual behavior a useful signal? Using daily returns of SPDR S&P 500 (SPY) and VXX from the inception of the latter on 1/30/09 through 2/17/12 (770 trading days), we find that:

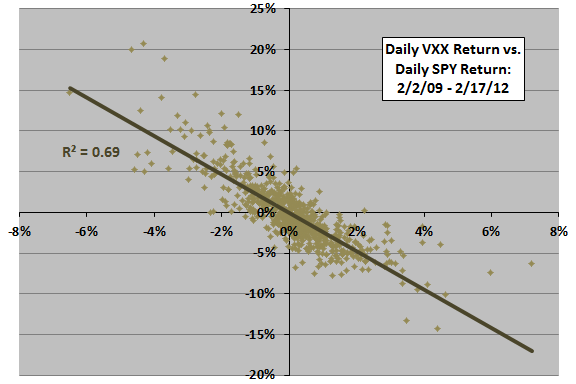

The following scatter plot relates daily VXX return to same-day SPY return, confirming a belief that SPY and VXX usually move in opposite directions (most points are in the upper left and lower right quadrants). The Pearson correlation for the relationship is -0.83 and the R-squared statistic is 0.69, indicating that SPY returns explain 69% of VXX returns.

What happens after days corresponding to the upper right quadrant (8% of observations) and the lower left quadrant (11% of observations)?

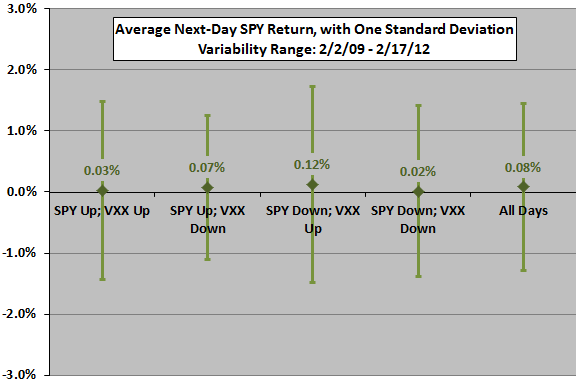

The next chart summarizes average next-day SPY returns, with one standard deviation variability ranges, for different combinations of SPY and VXX behaviors over the available sample period. There is some indication that SPY tends to be abnormally weak the day after unusual SPY-VXX return combinations, but no indication that shorting SPY would be profitable for any combination.

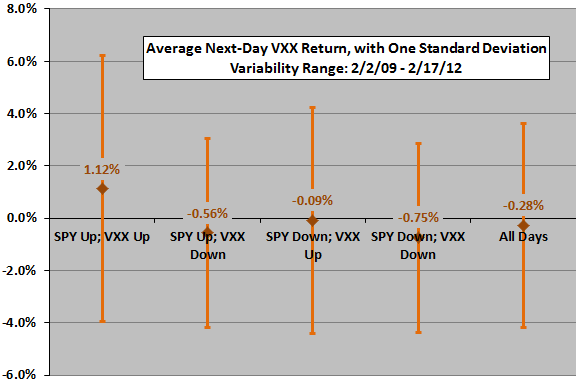

How about VXX next-day returns?

The next chart summarizes average next-day VXX returns, with one standard deviation variability ranges, for different combinations of SPY and VXX behaviors over the available sample period. There are indications that VXX is especially strong (weak) on days after SPY and VXX are both up (down).

Are these indications exploitable?

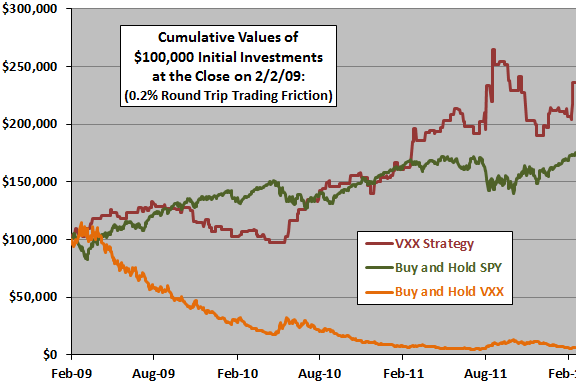

The next chart tracks cumulative value of a $100,000 initial investment at the close on 2/2/09 of a VXX trading strategy based on the following assumptions:

- Go long (short) VXX the day after SPY and VXX both go up (down). Assume signals are decisive enough just before the close to trade at the same close. Exit at the following close (conservative since there are some consecutive like signals).

- Otherwise do nothing.

- Baseline round trip trading friction is 0.2% of the balance. Shorting costs are negligible, and there are no restrictions on shorting VXX.

- Cash earns nothing.

The chart also shows cumulative values for buying and holding SPY and VXX for comparison. Results indicate that the VXX trading strategy may be attractive, though volatile, despite being active only 18% of the time (long 7.5% and short 10.8%). The average daily return of the VXX trading strategy is 0.13%, with standard deviation of daily returns 1.84%.

The Pearson correlation between VXX strategy returns and SPY returns is -0.01, suggesting that the VXX trading strategy may be a good diversifier of U.S. equities.

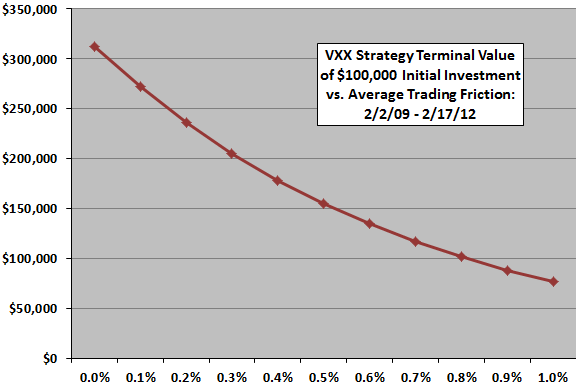

How do results vary with assumed level of trading friction?

The final chart summarizes variation of the terminal value of the above VXX trading strategy with assumed level of round trip trading friction. Results indicate that the strategy is profitable over the sample period for reasonable levels of trading friction.

In summary, evidence from simple tests on available data suggests that buying (selling) VXX on days after SPY and VXX both go up (down) may be attractive, with the series potentially useful as a diversifier of SPY.

Cautions regarding findings include:

- The available sample period is short in terms of variety of market conditions (essentially a single bull market), and cumulative value analyses can be sensitive to start and stop dates.

- As noted, the analysis ignores any cost of, and restrictions on, shorting VXX. Also, round trip trading friction may vary with market conditions.

- There is some data snooping bias associated with number of combinations considered, and perhaps with the original suggestion.