Do technical indicators add value to fundamental indicators in assessing broad stock market valuation? In their March 2011 paper entitled “Forecasting the Equity Risk Premium: The Role of Technical Indicators”, Christopher Neely, David Rapach, Jun Tu and Guofu Zhou examine the powers of technical and fundamental indicators to predict stock market returns. They consider 12 variations of three stock market index technical indicators: (1) relative values of two moving averages (1 month versus 3, 6, 9 and 12 months); (2) return momentum (past 3, 6, 9 and 12 months); and, (3) relative values of two on-balance volume moving averages (1 month versus 3, 6, 9 and 12 months). They consider 14 fundamental indicators ranging from stock market valuation ratios to Treasury yields, yield spreads and the default spread. They compare mean squared equity risk premium forecast errors for technical and fundamental indicators to that for the historical average premium. They also compare the average utility gain for a mean-variance investor who allocates monthly between stocks and Treasury bills based on either technical or fundamental market forecasts to that for an investor who uses the historical average premium. Finally, they generate equity risk premium forecasts based on a rolling principal component analysis that encapsulates the predictive powers of the 26 technical and fundamental indicators into three or four variables. Using monthly price and volume data for the dividend-adjusted S&P 500 Index and monthly readings of the 14 U.S. fundamental indicators as available over the period 1927 through 2008 (1926-1959 for in-sample optimization and 1960–2008 for out-of-sample testing), along with NBER business expansion and contraction dates, they find that:

- Regarding the power of the 14 fundamental indicators to predict the equity risk premium during the 1960-2008 out-of-sample test:

- Nine produce lower mean squared forecast errors than the historical average equity risk premium. Results for three of these nine are moderately statistically significant. Dividend-price ratio and dividend yield perform best.

- Eight produce a larger investor utility gain than the historical average equity risk premium. Dividend yield performs best, with an overall annualized utility gain of 1.71% (−0.01% during economic expansions and 11.4% during recessions).

- Regarding the power of the 12 technical indicators to predict the equity risk premium during the 1960-2008 out-of-sample test:

- Six produce lower mean squared forecast errors than the historical average equity risk premium. Results for three of these six (based on longer-term moving averages and momentum) are moderately statistically significant.

- Nine produce a larger investor utility gain than the historical average equity risk premium. The longest-term moving average indicator performs best, with an overall annualized utility gain of 2.98% (0.89% during economic expansions and 14.9% during recessions).

- In general, benefits of forecasts concentrate in recessions, with fundamental (technical) indicators detecting the typical rise (decline) in the equity risk premium near cyclical troughs (peaks). The two approaches are thus complementary.

- The rolling principal component analysis on the combined set of 26 indicators, with an annualized utility gain of 3.86% during 1960-2008 (1.04% during expansions and 19.9% during recessions), outperforms individual fundamental and technical indicators (see the chart below).

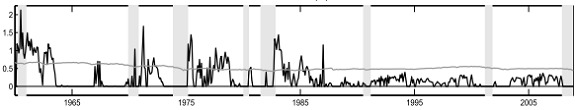

The following chart, taken from the paper, compares the equity risk premium forecast in percent for the rolling principal component analysis combining all 14 fundamental and 12 technical indicators (black line) to the historical average equity risk premium (gray line) during the 1960-2008 out-of-sample test. Vertical shaded bars mark NBER-dated recessions. Over the first half of the test period, the combination forecast is typically well below (above) the historical average forecast near cyclical peaks (troughs). However, the combination forecast presents no stock market “buy” signals after the mid-1980s, suggesting some systemic change in market predictability.

In summary, evidence suggests that technical indicators are as important as fundamental indicators for forecasting the equity risk premium.

Cautions regarding these findings include:

- The forecast modeling approach is complex and requires collection of large amounts of data. Tracking and processing of this data entails costs not considered in the study.

- Utility gain calculations appear not to consider any trading frictions for monthly asset reallocation. Including realistic trading frictions may alter conclusions.

- Even though the methodology incorporates an in-sample parameter-setting subperiod followed by an out-of-sample forecasting subperiod, there may be material data snooping bias imported via test variable selection from prior studies on the latter subperiod. In other words, success from mining the 1960-2008 data by other researchers may have influenced selection of variables for testing.

- Since NBER specifies expansion/recession states only retroactively, an investor cannot readily exploit elevated variable predictive powers during recessions based on NBER dates.

- As noted above, aggregate predictive power appears to dissipate after the mid-1980s (at least as benchmarked by the the historical equity risk premium). Confounding of dividend yield by growth in stock buybacks is a possible culprit.

One perspective on the findings is that a lot of effort yields a modest gross edge of no value over the past generation.