Cheap Options for Stock Market Crash Protection

March 24, 2023 - Equity Options, Strategic Allocation

Does the difference in individual stock/market return relationships between good times (relatively low correlations) and bad times (relatively high correlations) present an easy and efficient way to hedge against stock market crashes (tail risk)? In their March 2023 paper entitled “Tail Risk Hedging: The Search for Cheap Options”, Poh Ling Neo and Chyng Wen Tee test the ability of a portfolio of liquid but cheap put options on individual stocks to protect against equity market crashes. They reason that:

- These options are inexpensive compared to equity index put options.

- During good times, the relatively low return correlations across stocks limit option portfolio drag.

- During market crashes, the spike in these correlations confers on the option portfolio tail risk protection comparable to that of equity index put options.

Their tests encompass three stock market regimes: (1) up months have positive monthly returns and no daily return less than -5%; (2) down months have negative monthly returns but no daily return less than -5%; and, (3) tail risk months have at least daily return less than -5%. At the end of each month, they construct a crash protection put option portfolio as follows:

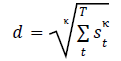

- Select an out-of-the-money put option for each optionable stock with delta closest to -10% and six months to a year until expiration.

- Exclude those with ex-dividend dates prior to expiration.

- Exclude those with bid-ask spreads over 50% of the bid-ask midpoint.

- Allocate 2% of the value of the S&P 500 Index position equally to each of the cheapest 20% of remaining put options.

Most analyses assume option buys and sells occur at bid-ask midpoints (no frictions), but they do look at impacts of effective bid-ask spreads up to 50% of the quoted spread. Using daily returns for the S&P 500 Index, S&P 500 Index put options and individual U.S. stock put options during January 1996 through December 2020, they find that: Keep Reading