Volatility Effects

Reward goes with risk, and volatility represents risk. Therefore, volatility means reward; investors/traders get paid for riding roller coasters. Right? These blog entries relate to volatility effects.

January 30, 2026 - Strategic Allocation, Volatility Effects

One concern about simple momentum strategies is data snooping bias impounded in selection of the lookback interval(s) used to measure asset momentum. To circumvent this concern, we consider the following argument:

- The CBOE Volatility Index (VIX) broadly indicates the level of financial markets distress and thereby the tendency of investors to act complacently (when VIX is low) or to act in panic (when VIX is high).

- Complacency translates to resistance in changing market outlook (long memory and lookback intervals), while panic translates to rapid changes of mind (short memory and short lookback intervals).

- The inverse of VIX is therefore indicative of the actual aggregate current lookback interval affecting investor actions.

We test this argument by:

- Setting a range for VIX using monthly historical closes from January 1990 through December 2006, before the sample period used for most tests of the Simple Asset Class ETF Momentum Strategy (SACEMS).

- Applying buffer factors to the bottom (0.9) and top (1.1) of this actual inverse VIX range to recognize that it could break above or below the historical range in the future.

- Segmenting the buffer-extended inverse VIX range into 12 equal increments and mapping these increments by rounding into momentum lookback intervals of 1 month (lowest segment) to 12 months (highest segment).

- Applying this same method to future end-of-month inverse VIX levels to select the SACEMS lookback interval for the next month.

We test the top one (Top 1), the equal-weighted top two (EW Top 2) and the equal-weighted top three (EW Top 3) SACEMS portfolios. We focus on compound annual growth rate (CAGR), maximum drawdown based on monthly measurements, annual returns and Sharpe ratio as key performance statistics. To calculate excess annual returns for the Sharpe ratio, we use average monthly yield on 3-month Treasury bills during a year as the risk-free rate for that year. Benchmarks are these same statistics for tracked (baseline) SACEMS. Using monthly levels of VIX since inception in January 1990 and monthly dividend-adjusted prices of SACEMS assets since February 2006 (initial availability of a commodities ETF), all through December 2025, we find that: Keep Reading

December 26, 2025 - Equity Premium, Sentiment Indicators, Volatility Effects

In response to our inquiry about Goldman Sachs Panic Index data, Grok responded that the data are proprietary and unavailable. However, Grok offered “several high-quality public proxies and near-replicas…built by traders and quants using only freely available data. These reconstructions correlate extremely closely (often 0.90–0.98) with the snippets Goldman has shown clients over the years.” For one of these proxies, the percentile rank of VIX within its trailing 2-year window (0-100 scale), Grok provided a Python script to generate an historical daily series. Is it predictive of U.S. stock market returns? To investigate, we run the script to generate daily Panic Index Proxy data from the end of 2015 through November 2025 and relate the series to contemporaneous daily S&P 500 Index (SP500) returns. Using these two series, we find that: Keep Reading

October 7, 2025 - Equity Premium, Momentum Investing, Strategic Allocation, Value Premium, Volatility Effects

How can investors and fund managers best exploit premiums associated with value, momentum, profitability, investment and low volatility factors, either to generate absolute return or to beat a market benchmark? In his September 2025 paper entitled “Strategic Style Allocation: Absolute or Relative?”, Pim van Vliet examines strategic allocation across long-only, value-weighted versions of these equity factors, depending on objective: absolute return or benchmark outperformance. To assess absolute return, he evaluates Sharpe ratios of factor allocations. To assess benchmark outperformance, he evaluates information ratios of factor allocations. He also investigates dynamic allocation between low volatility and the other factors, with portfolio adjustment frictions. Using long-only U.S. value-weighted factor returns during July 1963 through May 2025 and global factor index returns during January 1999 through March 2025, he finds that: Keep Reading

September 22, 2025 - Bonds, Equity Premium, Volatility Effects

Does the ICE BofAML MOVE Index, the implied volatility of U.S. Treasuries as derived from options on U.S. Treasuries with maturities 2, 5, 10 and 30 years, usefully predict U.S. stock market and U.S. Treasury bond returns? To investigate, we perform two sets of calculations using SPDR S&P 500 ETF (SPY) as a proxy for the U.S. stock market and iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for U.S. Treasury bonds:

- Lead-lag analyses using correlations between end-of-month MOVE Index or change in MOVE Index and monthly SPY or TLT returns.

- Average next-month SPY or TLT returns by ranked fifth (quintile) of end-of-month MOVE Index or change in MOVE Index.

Using end-month MOVE Index levels and monthly dividend-adjusted SPY and TLT data during November 2002 (limited by MOVE Index data) through August 2025, we find that: Keep Reading

September 17, 2025 - Volatility Effects

Can investors exploit the uneven playing field of leveraged and inverse exchange-traded fund (LETF) share creation and redemption? In his August 2025 paper entitled “Leveraged ETF Issuance During Market Stress and the Mechanics of Profit: Who’s the Dog, Who’s the Tail?”, Rob Bezdjian focuses on daily share creation and redemption for ProShares UltraPro QQQ (TQQQ), the largest LETF with more than $25 billion in assets. He determines whether these activities benefit the LETF offeror or investors. Using TQQQ price and share issuance data for January 2010 through mid-August 2025, he finds that: Keep Reading

September 15, 2025 - Equity Premium, Momentum Investing, Size Effect, Value Premium, Volatility Effects

Are equity multifactor strategies, as implemented by exchange-traded funds (ETF), attractive? To investigate, we consider eight multifactor ETFs, all currently available:

- iShares Edge MSCI Multifactor USA (LRGF) – holds large and mid-cap U.S. stocks with focus on quality, value, size and momentum, while maintaining a level of risk similar to that of the market. The benchmark is iShares Russell 1000 (IWB).

- iShares Edge MSCI Multifactor International (INTF) – holds global developed market ex U.S. large and mid-cap stocks based on quality, value, size and momentum, while maintaining a level of risk similar to that of the market. The benchmark is iShares MSCI ACWI ex US (ACWX).

- Goldman Sachs ActiveBeta U.S. Large Cap Equity (GSLC) – holds large U.S. stocks based on good value, strong momentum, high quality and low volatility. The benchmark is SPDR S&P 500 (SPY).

- John Hancock Multifactor Large Cap (JHML) – holds large U.S. stocks based on smaller capitalization, lower relative price and higher profitability, which academic research links to higher expected returns. The benchmark is SPY.

- John Hancock Multifactor Mid Cap (JHMM) – holds mid-cap U.S. stocks based on smaller capitalization, lower relative price and higher profitability, which academic research links to higher expected returns. The benchmark is SPDR S&P MidCap 400 (MDY).

- JPMorgan Diversified Return U.S. Equity (JPUS) – holds U.S. stocks based on value, quality and momentum via a risk-weighting process that lowers exposure to historically volatile sectors and stocks. The benchmark is SPY.

- Xtrackers Russell 1000 Comprehensive Factor (DEUS) – seeks to track, before fees and expenses, the Russell 1000 Comprehensive Factor Index, which seeks exposure to quality, value, momentum, low volatility and size factors. The benchmark is IWB.

- Vanguard U.S. Multifactor (VFMF) – uses a rules-based quantitative model to evaluate U.S. common stocks and construct a U.S. equity portfolio that seeks to achieve exposure to multiple factors across market capitalizations (large, mid and small). The benchmark is iShares Russell 3000 (IWV).

We focus on monthly return statistics, along with compound annual growth rates (CAGR) and maximum drawdowns (MaxDD). Using monthly returns for the seven equity multifactor ETFs and benchmarks as available through August 2025, we find that: Keep Reading

August 8, 2025 - Volatility Effects

Can investors profitably trade the effects of leveraged and inverse exchange-traded funds (LETF) share creation and redemption on prices? In his July 2025 paper entitled “Am I the Patsy? LETF Issuance is Signal, Not Noise: How Trading LETFs a Day Late can make you a Dollar Richer”, Rob Bezdjian introduces the “Day Late-Dollar Richer” (DLDR) strategy, which exploits LETF share creation and redemption behaviors. Issuers of LETFs must, in aggregate, overprice created shares and underprice redeemed shares to remain solvent. DLDR therefore uses LETF share data (typically released by 8:00PM ET) to trade opposite issuers at the next close, as follows:

- If the number of shares increases, sell or short at the next close.

- If the number of shares decreases, buy or close short at the next close.

- If the number of shares is unchanged, do not trade.

Testing assumes trades occur at net asset values (NAV) with opening trade sizes equal to changes in number of shares. Applying DLDR as modeled to four volatility and eight commodities ProShares LETFs during January 2015 (or inception) through mid-July 2025, he finds that:

Keep Reading

August 4, 2025 - Volatility Effects

Does asymmetry in the design/performances of leveraged and inverse exchange-traded products create a reliable edge? In his July 2025 paper entitled “Deception by Design: Leveraged ETFs, Structural Fraud, and Proof of Outperformance”, Rob Bezdjian analyzes the general construction and performance of leveraged and inverse exchange-traded funds (ETF). He then devises and tests a (“Handsome Rob”) strategy that shorts related pairs of leveraged:inverse ETFs at a 1:1.5 ratio, rebalanced quarterly, with a top-up rule that amplifies exposure only after price declines. Using mathematical models and historical data for six pairs of leveraged and inverse ETFs from the first quarter of 2016 through the second quarter of 2025, he finds that: Keep Reading

July 10, 2025 - Volatility Effects

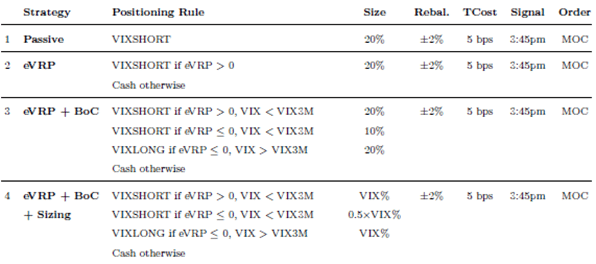

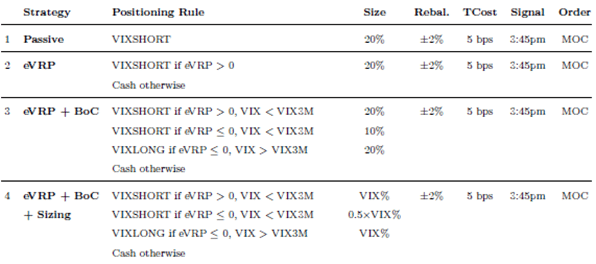

Can investors safely capture the U.S. stock market volatility risk premium (VRP), the tendency of implied volatility to exceed realized volatility. In their June 2025 paper entitled “The Volatility Edge, A Dual Approach For VIX ETNs Trading”, Carlo Zarattini, Andrew Aziz and Antonio Mele concisely review the history of volatility trading. They then investigate whether investors can capture some of VRP via the following four progressively constructed strategies (table from the paper):

- Strategy 1 is a benchmark, a continuous 20% position in VIXSHORT (modeled from the S&P 500 VIX Short-Term Futures Inverse Daily Index with 0.80% annual fee). The remaining 80% is in cash with no earned interest. Rebalancing occurs via market-on-close (MOC) trades whenever the VIXSHORT allocation drifts from 20% by at least 2% as measured daily at 3:45pm, with 0.05% trading frictions (Tcost).

- Strategy 2 is the same as Strategy 1, except the VIXSHORT allocation is made only when the expected VRP (eVRP) is positive when measured daily at 3:45pm as VIX minus the annualized standard deviation of 10-day (3:45pm) SPDR S&P 500 ETF (SPY) returns.

- Strategy 3 adds a signal to Strategy 2, with allocations to VIXSHORT or VIXLONG (modeled from S&P 500 VIX Short-Term Futures Index Total Return with 0.50% annual fee), depending on whether the 3:45pm VIX term structure is in backwardation or contango (BoC), meaning that 90-day implied volatility (VIX3M) is less than or greater than VIX.

- Strategy 4 replaces the fixed allocations in Strategy 3 with allocations based on the 3:45pm level of VIX.

Using daily and 1-minute intraday data for the specified input variables during January 2005 through May 2025, they find that:

Keep Reading

July 2, 2025 - Volatility Effects

Given the body of research on the outperformance of low-risk stocks, should the equity asset pricing community add a low-volatility factor in standard models of stock returns? In their June 2025 paper entitled “Factoring in the Low-Volatility Factor”, Amar Soebhag, Guido Baltussen and Pim van Vliet investigate adding a low-volatility factor to standard models via four scenarios:

- Gross (frictionless) returns for long-minus-short portfolios for all factors as conventionally done in prior factor model research.

- Gross returns for market-hedged long and short legs as separate aspects of all factors.

- Net returns approximated from estimated bid-ask spreads and shorting fees for separate market-hedged long and short legs of all factors.

- Net returns for only the long legs of all factors.

They compute stock volatilities based on a rolling window of 252 trading days for low-volatility factor calculations. They compare models by weighting their respective factors at each rebalancing to achieve maximum test period Sharpe ratio. Using firm/stock data for U.S. common stocks with positive book-to-market ratios to construct long-minus-short and long or short factor returns for well-known asset pricing models, and estimated trading frictions and shorting costs, during January 1970 through December 2023, they find that:

Keep Reading