SACEVS and SACEMS Performance by Calendar Month

April 24, 2023 - Calendar Effects, Strategic Allocation

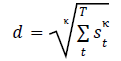

A subscriber asked whether the Simple Asset Class ETF Momentum Strategy (SACEMS) exhibits monthly calendar effects. In investigating, we also look at the Simple Asset Class ETF Value Strategy (SACEVS)? We consider the Best Value (most undervalued asset) and Weighted (assets weighted by degree of undervaluation) versions of SACEVS. We consider the Top 1, equal-weighted (EW) Top 2 and EW Top 3 versions of SACEMS, which each month holds the top one, two or three of nine ETFs/cash with the highest total returns over a specified lookback interval. We further compare seasonalities of these strategies to those of their benchmarks: for SACEVS, a monthly rebalanced 60% stocks-40% bonds portfolio (60-40); and, for SACEMS an equal-weighted and monthly rebalanced portfolio of the SACEMS universe (EW All). Using monthly gross total returns for SACEVS since August 2002 and for SACEMS since July 2006, both through March 2023, we find that: