Returns for Stocks Entering and Leaving Factor Indexes

October 28, 2016 - Equity Premium

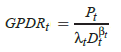

Do stocks entering (exiting) factor indexes experience a price jump (drop) due to increased (decreased) demand? In their October 2016 paper entitled “Price Response to Factor Index Decompositions”, Joop Huij and Georgi Kyosev examine price impacts for stocks entering and exiting MSCI Minimum Volatility factor indexes covering U.S., European, global and emerging markets. To isolate the factor index effect, they exclude changes affecting both a factor index and its parent broad market index and changes due to corporate actions (such as spin-off or acquisition). They distinguish between the effective day (ED) of a change (first day the change occurs in the index portfolio) and the announcement day (AD) of a change (nine business days before ED). They define daily abnormal return of a stock as return in excess of the return of its factor index. They define daily abnormal trading volume of a stock as the ratio of dollar trading volume of the stock to dollar trading volume of its factor index, multiplied by the ratio of average dollar trading volume of the index to average dollar trading volume of the stock during a 40-day window ending 10 days before AD. Using index changes and daily returns and trading volumes of all stocks in the Minimum Volatility factor indexes and their parent broad market indexes during November 2010 through December 2015 (11 index rebalancings), they find that: Keep Reading